The banking app Capital One Mobile offers note-free credit transfers. Open the app and begin paying whether you’re at a grocery store or gas station. You no longer need the cash, so leave your wallet and cash at home. Having the wallet with you the entire time is a huge relief.

This software boasts an engaging layout and a dynamic user interface. Enrolling in it is quite easy. Using your fingerprint, you may launch the app. The smartphone is transformed into a personal digital wallet by it. This software offers everything needed for secure, private banking in terms of security.

Its dashboard is simple to use and allows you to quickly check the current balance. Virtual credit card management is made simple by it. It is compatible with several credit cards. It is capable of wireless payment transfers with NFC support. Its ATM locator assists you in locating the closest ATM.

The first-time online check deposit system makes it more accessible. Because of its special features and accessibility, this software is, in summary, a creative and effective banking solution. You can explore a lot of different options instead of Capital One. View the list below for more.

Features

- Secure and effective

- Interactive interface

- No signup fees

- Quick Login

- Online check deposit

Apps Like Capital One Mobile

1) Any Time Check

Users may send and receive payment checks instantly using the Anytime Check app. It’s a simple suggestion for handling payments and assessments. Users of this program can quickly create electronic checks with its assistance. It saves time and energy at the same time, in addition to more about Anytime Check. Review management is not necessary for users. Anytime Check provides tools and sends and receives checks using high-quality software technology.

2) Dwolla

A comprehensive tool for account-to-account installment plans is Dwolla. Employers only need one API combination to access ACH, wire transfers, periodic installments, push-to-charge, and more. Excellent for all sizes of enterprises that have account-to-account installments to collect, transmit, or handle. At the moment, Dwolla regularly develops millions of dollars with cheap exchange rates, straightforward automation, and superior near dependability. This platform is being driven by a fintech company that creates intricate record-to-account installment plans.

3) Zlich

With the slogan “Buy Now, Pay Later,” zilch is a unique service. designed from the ground up to make it easy for everyone to accomplish, possess, and be anything they choose. Try Zilch: Buy now, pay later if you’re short on funds and need something immediately. Purchase items now and pay for them later at thousands of local and online retailers with no extra fees, no surprise charges, and 0% APR.

4) Google Pay

Using your smartphones and tablets from home to make payments and manage your finances is made easy, practical, and secure with Google Pay. The Google Pay: Save, Pay, Manage App facilitates money transfers, online and in-store payments, tracking of transactions, and sending and receiving of funds. You can send money to friends, relatives, and other people using it without having to pay extra.

5) Revolut

Revolut is a big platform where you can handle everything directly or indirectly linked to your money, from payments to money transfers and everything in between. Join the millions of contented individuals from around the globe who are effortlessly managing their finances by signing up with them. Unlock all the incredible tools that make it simple to get more out of your money every day, like managing finances, making payments, and transferring funds.

6) PayGo Wallet

PayGo Wallet offers a variety of sophisticated and distinctive ways to conduct mobile electronic payments. Your virtual MasterCard may be created in an instant, and you can use it to pay for groceries, bills, internet shopping, and other purchases. You can buy any program you want from the Google Play Store and Stickers for LINE Messenger with its assistance. Users can purchase or reserve airline tickets without incurring any additional fees by connecting their virtual masker card to PayPal.

7) Monese

Monese is a good and safe method of transferring money, and it’s available for both iOS and Android. Monese is being used in nearly thirty nations as a bank substitute. You may use your Mastercard debit card, check your accounts, transfer and receive money with ease, and get your pay deposited straight into your account. Simply download the app, fill out the necessary details, and within minutes, open a bank account. It makes no difference if you have a EUR IBAN account or a GBP one.

8) ePayments

ePayments makes it simple to handle your finances, conduct online transactions, and accept money from partners and businesses. For those who work online, ePayments: wallet & bank card is a user-friendly electronic wallet. With the ePayments Prepaid MasterCard, you may accurately receive payments from partners and employers, make service payments, and withdraw cash. ePayments: A freelancer’s payment alleviation The app makes transferring funds to your ePayments w-wallet simple.

9) Venmo

Using Venmo, managing your finances is made simple. You can pay for anything you want with the platform and earn rewards in addition to sending and receiving money. The Venmo: Send Money, Pay & Earn Rewards app is a fantastic, quick, and safe way to send money and receive payments. More than 65 million users from around the globe use this community to manage their funds through this application.

10) Payoneer

Payoneer offers a remarkable method for handling your business payments while on the go, as well as for keeping track of every aspect related to the currencies you own. Millions of professionals worldwide can pay you in a preferred manner when you withdraw your funds locally. You may easily pay contractors, vendors, freelancers, service providers, and other online services using it. It is a top-tier international payment solution suitable for practically all kinds of enterprises.

11) Manzo

One of the safest and fastest-growing banks in the UK, Monzo is soon to make its way to the United States. One of Monzo Inc.’s amazing products, Monzo Bank – Making Money Work for Everyone, enables everyone to take advantage of many benefits such as easy budgeting, real-people support, and stress-free travel. This elegant and cost-free financial app is compatible with your Hot Coral debit card and Google Pay virtually everywhere in the world.

12) Paypal

One of the best and most reliable money apps and mobile wallets is PayPal, which offers one of the simplest methods for sending money, making payments, managing cryptocurrencies, and a lot more. Sending and receiving money from friends, relatives, and other account holders is made easy with this safe and straightforward money app. This program facilitates a variety of tasks such as managing transactions, selecting which currencies to transfer internationally, and monitoring PayPal activities.

13) QuadPay

Given that both apps provide comparable services, it could be justified to consider Quadpay to be comparable to Afterpay. Don’t stress and take it easy if you need to shop but are out of money. Your preferred brands are available; order them, have your request fulfilled within the allotted time, and pay the remaining balance via the account in four evenly spaced installments for forty-five days.

14) FingerHut

Fingerhut is the greatest platform for you if you want to raise your credit score from zero because it works with individuals who have no credit history. You may always stay informed about your orders, credit availability, current balance, upcoming payments, and payments by using the service. You’ll get a notification to improve your score before the payment deadline.

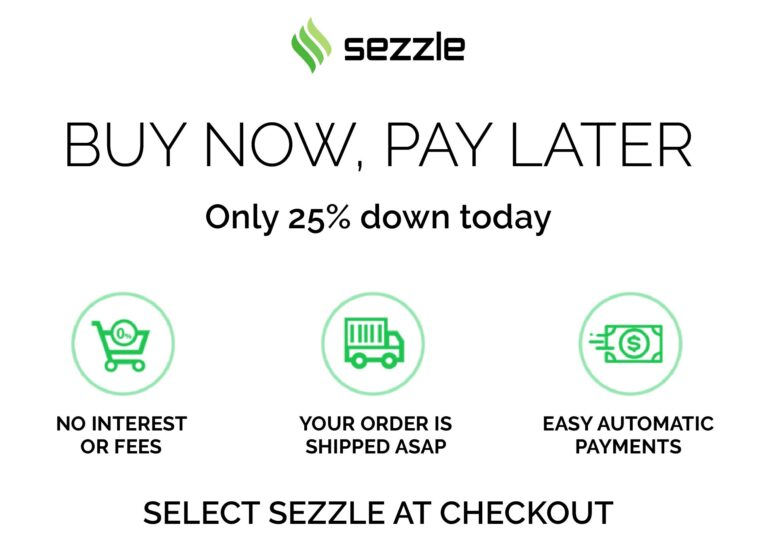

15) Sezzle App

Sezzle is the greatest substitute for Afterpay since it allows you to purchase a product now and pay for it later. Shop from thousands of stores, pick up your order at home, and pay the balance in full, interest-free, over six weeks. Not complicated at all, and simple to use. You may manage your current orders, find new stores, adjust your payment options, and receive alerts when your next payment is due.

16) Future Pay

There’s no denying that FuturePay is the most effective Afterpay substitute. Use FuturePay if you shop online and would like a flexible payment schedule spread out over time. There are never any unstated costs or conditions associated with any order. Just place your online order, and we’ll ship it to you. Up until the order’s complete payment is received, there is a $25 minimum installment required every month.

17) Cash App

During major holidays such as Christmas, Candlemas, Easter, Anzac Day, and others, people must send money to their relatives and friends so they can shop. In addition, some business owners must forward a sizable sum of money to their respects for the payment to be cleared. Sending them money via MoneyGram is a major issue since it takes too long.

18) Afterpay

An increasing number of people have benefited from the ease of online purchasing since the creation of the internet. With the Afterpay app, customers may buy goods without having to pay the full amount at once. Orders, previous Afterpay payments, and payment history are all manageable. You may access hundreds of the newest brands and retailers at your convenience with the built-in store.

Our Recommendation

We recommend Payoneer as it offers a remarkable method for handling your business payments while on the go. You may easily pay contractors, vendors, freelancers, service providers, and other online services using it. Millions of professionals worldwide can pay you in a preferred manner when you withdraw your funds locally. It is a top-tier international payment solution suitable for practically all kinds of enterprises.